personal property tax rate richmond va

Personal Property Taxes are billed once a year with a December 5 th due date. The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal property for 92 consecutive days or less.

1300 N 27th St Richmond Va 23223 Realtor Com

Of the due date will be considered as on time.

. Henricos proposed budget for next fiscal year which calls for lowering the countys real estate tax rate to 85 cents per 100 of assessed value would also slash by 74 percent the countys personal property tax rate for equipment used by biotechnology companies. If you have questions about personal property tax or real estate tax contact your local tax office. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Virginia is ranked number twenty one out of the fifty states in order of the average amount of property. Payments made using the coupons must be postmarked on the due date of the payment to be considered on time. Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year.

Places Receiving the Most Value for Their Property Taxes Show 2021. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Business Tangible Personal Property Tax Return2021 2pdf.

In case you missed it the link opens in a new tab of your browser. Business Tangible Personal Property Tax Return2021 2pdf. The tangible personal property tax is a tax based on the value of the property commonly referred to as an ad valorem tax.

Richmond VA Department of Finance Tangible Personal Property Taxes. Essex Ct Pizza Restaurants. The 10 late payment penalty is applied December 6 th.

Tangible personal property is the property of individuals and businesses in the city of Richmond. Personal Property Registration Form. The vehicle must be owned or leased by an individual and not used for business purposes to qualify for personal property tax relief.

Local Tax Rates 2018 3 Virginia Department of Taxation. Not all localities levy these taxes on 100 of assessed value. The online payment option provides you the ability to make the payment 247 and at your convenience.

Interest is assessed as of January 1 st at a rate of 10 per year. Local tax rates on vehicles qualifying for tangible personal property tax relief. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000.

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. 074 of home value. The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car motorcycle pickup or panel truck having a registered gross weight of less than 7501 pounds.

A collection fee of 30 is added to accounts more than 30 days delinquent. Opry Mills Breakfast Restaurants. Personal Property Tax Relief Does Your Vehicle Qualify for Personal Property Tax Relief.

Taxation Subtitle III. Local Taxes Chapter 35. A vehicle has situs for taxation in the county or if it is registered to a county address with the Virginia Department of Motor Vehicles.

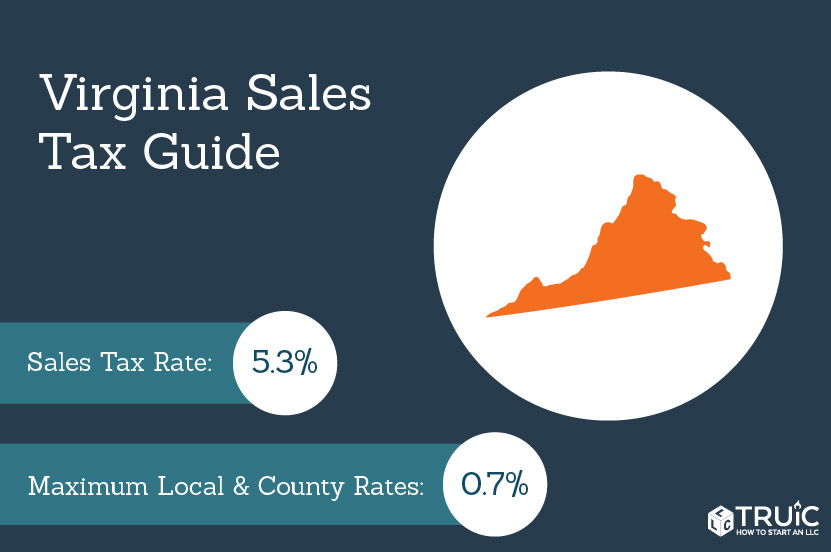

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. General classification of tangible personal property. The current total local sales tax rate in Richmond VA is 6000.

Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. Personal Property taxes are billed annually with a due date of December 5 th. Tax amount varies by county.

Table of Contents Title 581. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Yearly median tax in Richmond City.

For estimates of effective rates see Weldon Coopers Virginia Local Tax Rates 2018. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Real Estate Tangible Personal Property Machinery and Tools Merchants Capital Alexandria1130 0050 0045 -.

The biotech rate reduction from 350 to 90 cents per 100 of. Personal Property Tax Rate. The December 2020 total local sales tax rate was 5300.

If you can answer YES to any of the following questions. Payments remitted online by 1159 pm. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue.

Restaurants In Matthews Nc That Deliver. Income Tax Rate Indonesia. It has a population of around 224000 making it the fourth-largest city in the state.

Tangible personal property tax relief. Box 27412 Richmond VA 23269. Personal Property Tax Car Richmond Va.

Tax rates differ depending on where you live. Personal Property Car Tax Relief. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in.

Offered by City of Richmond Virginia. Richmonds average effective property tax rate is 101. For tax year 2006 and all tax years thereafter counties cities and towns shall be reimbursed by the Commonwealth for providing the required tangible personal property tax relief as set forth herein.

Soldier For Life Fort Campbell. The tax rate is 1 percent charged to the consumer at the time of rental payment. Need assistance with making your online.

The assessment on these vehicles is determined by the Commissioner of the Revenue. Personal property taxes are due May 5 and October 5. Tangible Personal Property Machinery and Tools and Merchants Capital Article 1.

Pay Personal Property Taxes. Majestic Life Church Service Times. Use the map below to find your city or countys website to look up rates due dates.

Personal Property Taxes. Pay Personal Property Taxes in the City of Richmond Virginia using this service. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

Boats trailers and airplanes are not prorated. Tangible Personal Property Tax 581-3503. Administrative fees are added for most collection processes liens garnishments registration holds judgments etc VA Code 581-3916.

Richmond Richmond is the capital of Virginia and the place where Virginias property tax laws were established.

5313 Masons Ln Richmond Va 23230 Realtor Com

Public Housing In Richmond Virginia Richmond Cycling Corps

Virginia Sales Tax Small Business Guide Truic

2021 Best Places To Buy A House In Richmond Area Niche

Tax Exempt Bond Program Richmond Redevelopment Housing Authority

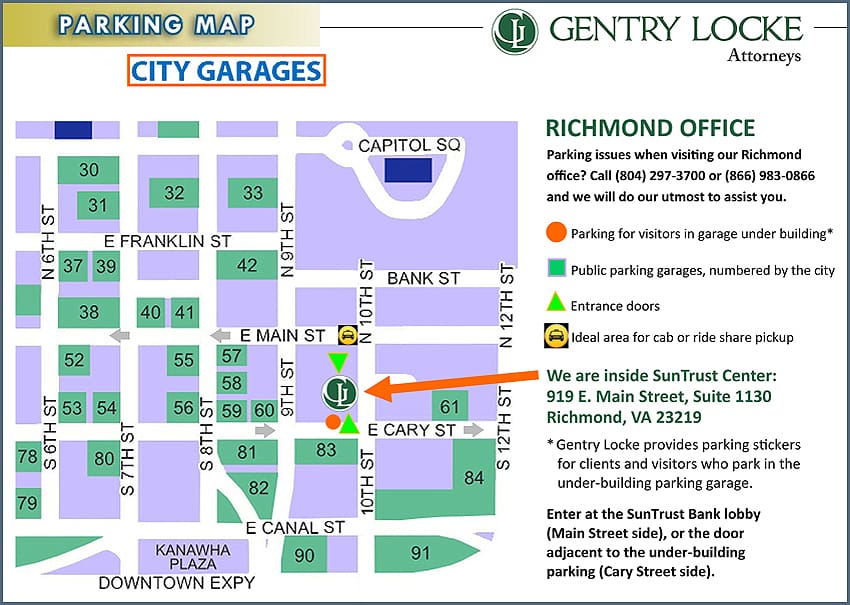

Visiting Our Richmond Office Gentry Locke Attorneys

The Best And Worst Cities To Own Investment Property Investing Investment Property City

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Town City Boundaries And Annexation

3001 Hanover Ave Richmond Va 23221 Realtor Com

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1211 W Franklin St Richmond Va 23220 Realtor Com

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

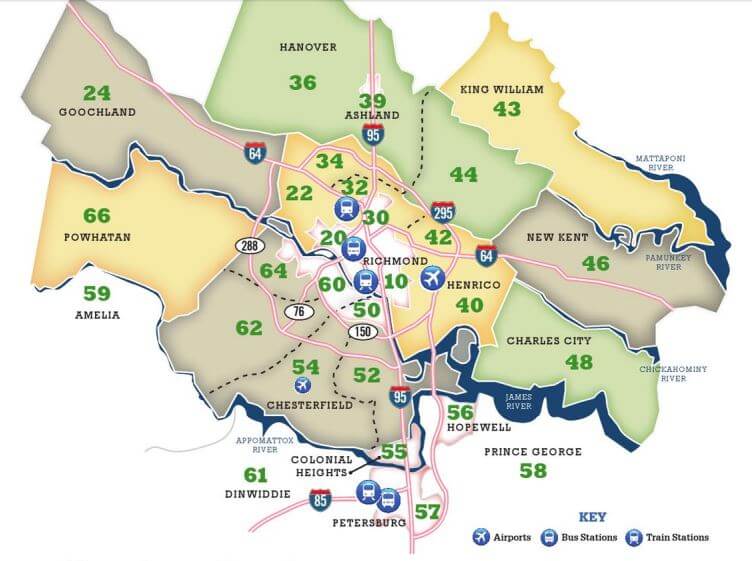

Guide To Richmond Area Mls Real Estate Zones Mr Williamsburg

Public Housing Program Richmond Redevelopment Housing Authority

1423 Floyd Ave Richmond Va 23220 Realtor Com

The Ultimate Richmond Relocation Guide

These Are The Best Places To Buy And Flip A Home Marketwatch Investing Real Estate Investing Real Estate Advice