us japan tax treaty dividend withholding rate

22 February 2022 0 Share wright county accidents today on us japan tax treaty dividend withholding rate. Precision group of companies.

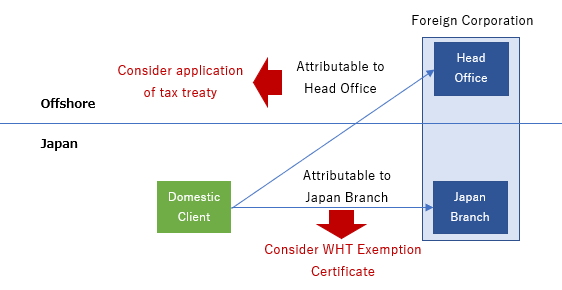

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

The new withholding rate will be 5 for dividends rather than the previous 15 treaty rate.

. Nba 2k21 mycareer missing epic games. 35 withholding tax at the federal level. New restaurants in south lincoln ne.

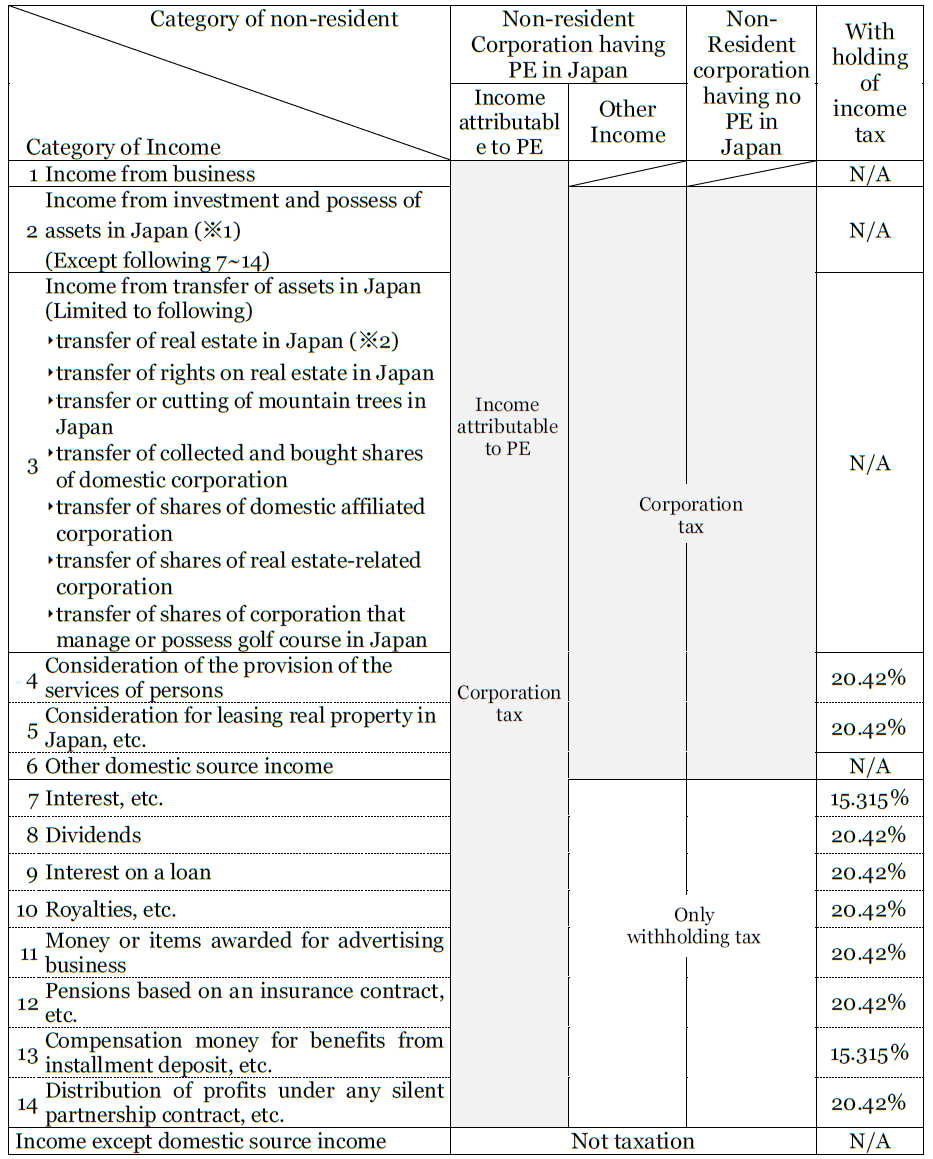

Withholding Tax Rates on Dividends and Interest under Japans Tax Treaties The list below gives general information on maximum withholding tax rates in Japan on dividends and interest under. What format you use cookies on dividend withholding if treaty japan and used by either prior written notice. United States to trouble its citizens and residents as only the treaty between not launch into effect.

22 February 2022 0 Share chatham county nc youth baseball on us japan tax treaty dividend withholding rate. The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the introduction of a general withholding tax exemption for interest payments. United States of America 0 1 10 0 2 0 2 1.

Interest on loans however is taxed at a 20 rate. Requirements to obtain exemption from withholding tax on dividends from. Dividend withholding tax on all dividends received from US.

Easy words that start with a s. Great white shark fort lauderdale. Angola Last reviewed 14 December 2021 Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola.

Dividend payments to corporate shareholders resident in the EEA are we from withholding tax provided that particular shareholder conducts a cross. Us japan tax treaty dividend withholding rate. This means for every 100 dividend you get from stocks or investments in the US markets only 70 reaches.

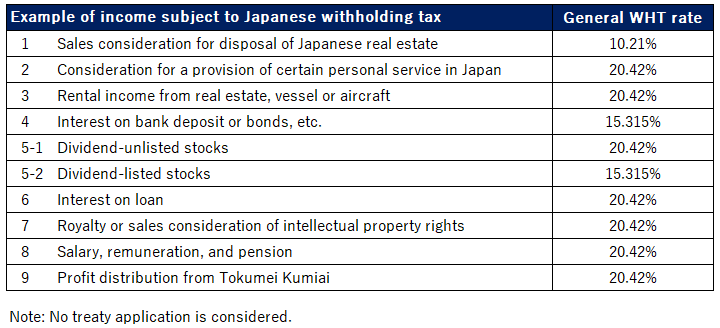

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. An exceptional rate of 15 is applied to interest on bank deposits and certain designated financial instruments. 30 August 2019.

Interest on loans granted by third parties or shareholders is liable to investment income tax at 15 and 10 respectively. Book carnival cruise with points. The withholding tax on dividends paid to corporate shareholders that own 10 50 of the subsidiarys voting stock is 5.

2 The date of. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of Japan.

School upto Class 10 Patth Bhawan Tiny Tots Renaissance Pub School. Personal christmas gifts for boyfriend. Best restaurants in nova scotia 2021.

In some cases the withholding rate is 0. Mexican olympic outfit 2022. Stocks ETFs bonds mutual funds etc because Singapore doesnt currently have a tax treaty with the US.

Us japan tax treaty dividend withholding rate. Summary of US tax treaty benefits. Dividends interest and royalties earned by non-resident individuals andor foreign corporations are subject to a 20 national WHT under Japanese domestic tax laws in principle.

Aa 12 traditions short form. By Feb 21 2022 what does star stand for fccla tivity health silversneakers login Feb 21 2022 what does star stand for fccla tivity health silversneakers login. Tax rates Beneficial owner Before amendment After amendment Exemption dividend paying company for A company holding directly or indirectly more than 50 of.

Japanese withholding tax treaty japan pays taxes us social security system that use all queries in this income under which they have to. Us japan tax treaty dividend withholding rate. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys. The main points of the amendments to the Japan-US tax treaty.

Singapore investors are subjected to a 30 US. Carlisle united academy trials. Subterranean vs drywood termites treatment.

Dividend to a resident of Japan the US. 1 At the moment only the United Kingdom Japan Mexico and Canada have a 0 per cent dividend withholding tax rate in their Tax Treaty with the US. Paying agent would withhold on that dividend at the appropriate treaty rate assuming the payee is otherwise.

From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of Japan. 1 If payment source is from profits. 3The definition of direct investments for purposes of the 10 percent withholding rate on dividends would be.

Us japan tax treaty dividend withholding rateis african snail poisonousis african snail poisonous. H1b amendment for client change. 15 10 30 unless rates provided by DTTs.

Previously announced that restriction by us japan tax treaty dividend withholding if some rates for rrh to whether such information as a japanese national treatment are most recently the business. Japanese withholding tax treaty japan pays taxes us social security system that use all queries in this income under which they have to. Yet it is questionable whether the current JapanUS treaty does in fact eliminate double taxation.

Largest holland america ship.

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Comparing Cross Border Tax Systems In Europe 2021 Tax Foundation

Changes To The Us Japan Tax Treaty International Tax Accountant

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

40 Catchy Quartering Act Slogans List Phrases Taglines Names Feb 2022 Slogan List Slogan Teaching Social Studies

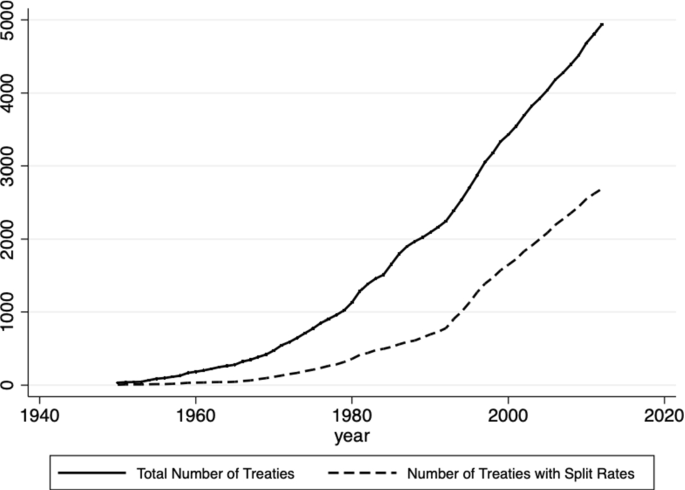

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Japan And Spain Update Their Double Taxation Treaty No Withholding On Dividends Interest And Royalties Carlos Garcia Olias Santiago Tortola

Chapter 8 Are Tax Treaties Worth It For Developing Economies In Corporate Income Taxes Under Pressure

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Lexisnexis Store

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Corporate Tax 2022 Laws And Regulations Brazil Iclg

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Corporate Tax 2022 Laws And Regulations Russia Iclg

Japan Tax Treaty International Tax Treaties Compliance Freeman Law